Reasons for Rates Mismatch: Invoice Template Upload

Joseph Yarborough (Unlicensed)

Anastasiya Dashuk (Unlicensed)

Chellie Esters

When submitting invoices via the line-item template, if it contains labor rates that are either below of above the agreed upon rates, they will be prompted to resubmit the invoice with a reason(s) for the rates mismatch.

Reason for Rates Mismatch is a one-to-one agreement. Providing a reason for rates mismatch is only required between clients and service providers who have established and enabled the Reason for Rates Mismatch relationship.

Windows Specific

Open file in Notepad

Choose Save As

There are three items to update in the Save dialog that comes up.

Save as type: change this to All FilesFile

Name: name your file and add the .csv extension to it - e.g.: myupdates.csv

Encoding: click on the dropdown and choose UTF-8

Save!

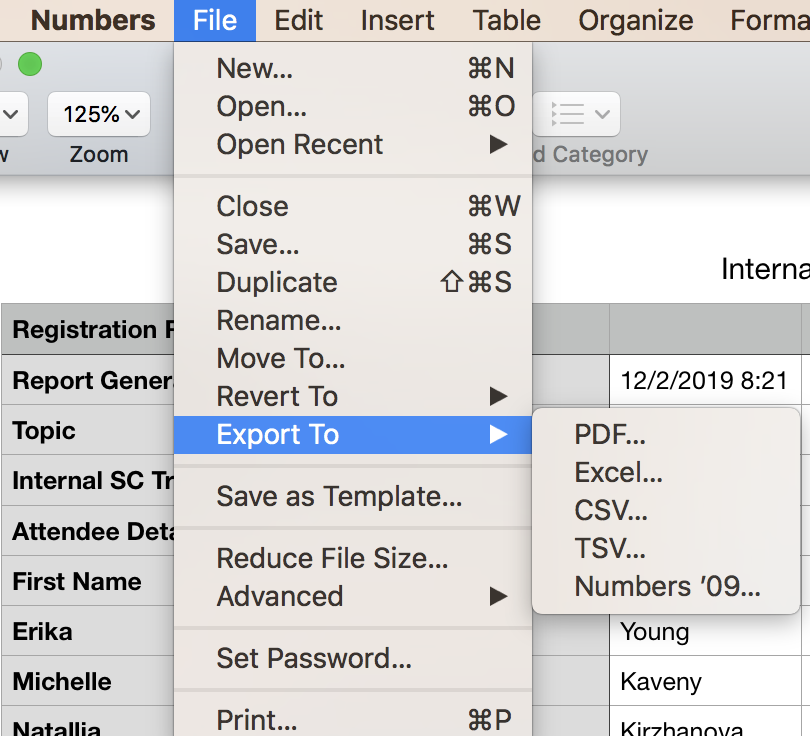

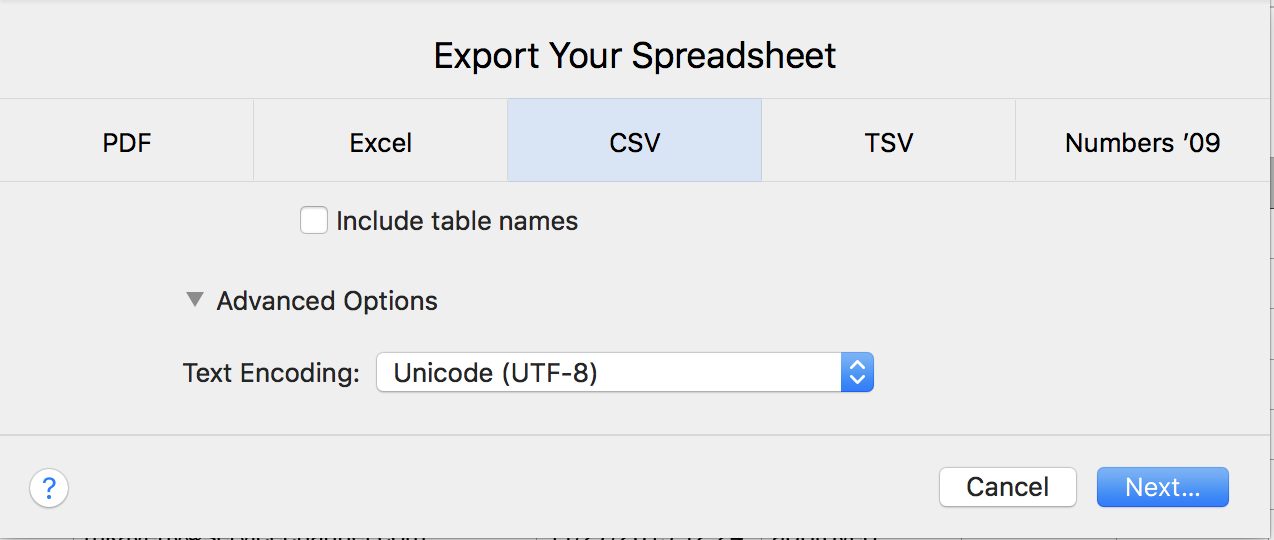

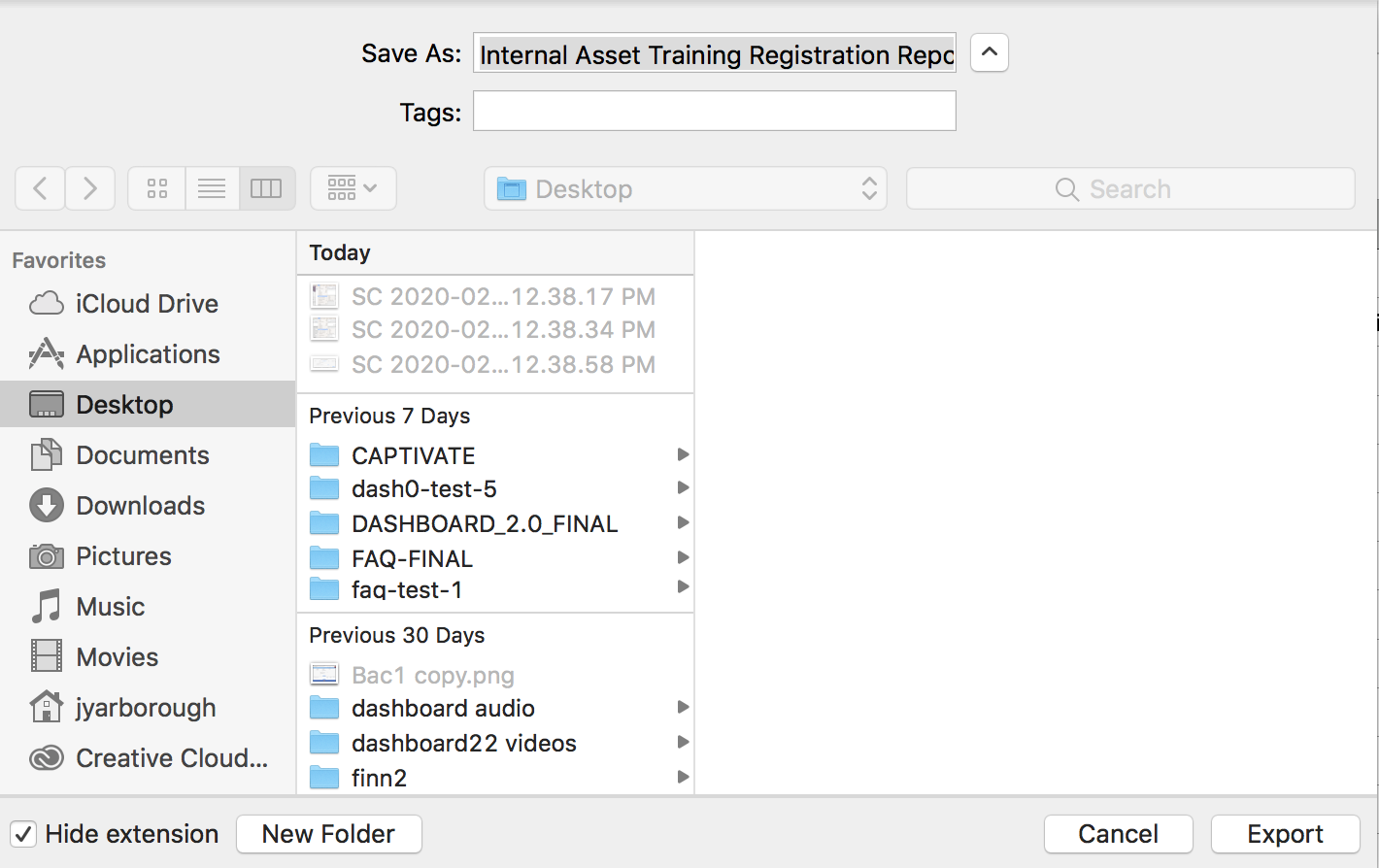

Mac Specific

- Open file in Number

- Hover over Export

- In the submenu that appears, choose CSV

- Click on Advanced Options to show the Text Encoding dropdown

- Select Unicode (UTF-8) from the dropdown menu

- Click Next Export!

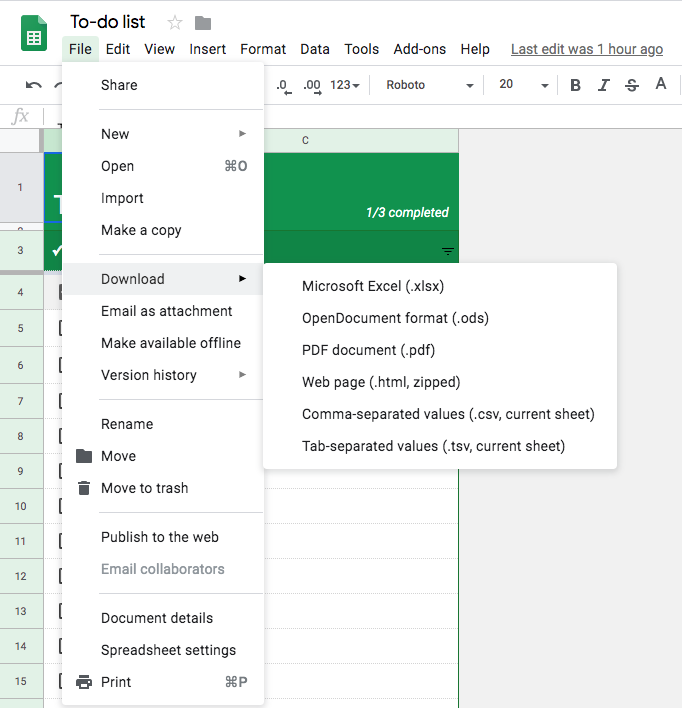

Google Sheets

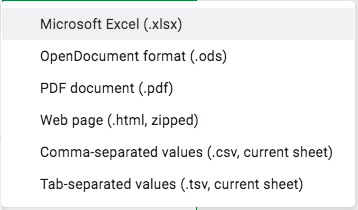

- Click File

- Click on or hover over Download As

- Choose the option Comma-separated values (.csv, current sheet)

- After clicking on that option, your file will be automatically downloaded to your computer

- Navigate to the Invoice screen, by selecting the Invoice link on the top of the interface.

- Click the Download/Upload menu and select Upload Invoice Template.

- If you are submitting an invoice for the United States or Canada click the l.14 link, to download the Excel optimized spreadsheet. All others select the l.15 link.

- Open the spreadsheet. (If you are not using Excel, ensure that the program you are using can save in the “xls” format)

The spreadsheet has 27 fields where values can be entered, however, not all fields are required for all invoices. The following list outlines the type of content/values that can entered into each field and whether or not they are required, based on the work done and or the client/ service provider agreement as listed in the service provider’s Fixxbook account.

| Field | Required | Value/Format | Location/Content/Restrictions |

|---|---|---|---|

| Template Version | Yes | Uppercase I I.14 or I.15 | Provided on first line of the template |

User ID | Yes | Not case sensitive | Info used to log into Service Automation. |

PIN | Yes | Numeric | IVR Pin number used to login to work orders. Can be found on work orders. |

Invoice # | Alphanumeric | You can use the work order number or a self generated alphanumeric combination. | |

Invoice Date | Yes | mm/dd/yyyy | Date cannot be before completion of work. |

TRACKING NUMBER | Yes | Numeric | On work order. |

Record Type | Yes | Record Type referrers to the information on a particular row and are always capital letters. Options are:

| N/A |

Skill Level | Yes, for Labor charges | Case Sensitive:

| Based on the worker type(s) that worked on the work order. Each Tech type must be entered on a separate row. |

Labor Type | Yes, for Labor charges | Case Sensitive:

| Based on the type of time worked. |

# Of Techs | Yes, for Labor charges | Numeric | Combined number of each type: Supervisors, Technicians and or Helpers who worked on the work order. Each Tech type must be entered on a separate row. |

Hourly Rate | Yes, for Labor charges | Numeric | Based on agreed upon amount listed in Service Provider’s Fixxbook account. See Client Rates in Fixxbook. |

Total Hours | Yes, for Labor charges | Numeric | Based on the combined number of hours for the “Tech” type. |

Labor Amount | Yes, for Labor charges | Numeric | Total hours for the Techs listed in the row. |

Travel Charge | Only if Travel Charges have been agreed upon | Numeric | Based on the Travel Charge agreed upon in Fixxbook. See Client Rates in Fixxbook. |

Material Description | Only if there are Material charges | Alpha | Description of Materials used on work order. Enter each “Material” used on a separate “M” line. |

Part # | Only if there are Material charges | Alphanumeric | The Part (Serial or Manufacturer) number. Enter each “Part” used on the corresponding “M” line. |

Price Per Unit | Only if there are Material charges | Numeric | Price for quantity of one. Enter each “Price Per Unit” used on the corresponding “M” line. |

Qty (Quantity) | Only, if there are Material charges | Numeric | Number of Parts used. Enter the “Qty” used on the corresponding “M” line. |

Material Amount | Only, if there are Material charges | Numeric | Total amount for Material. Each “material type” must be entered on a separate “M” line. |

Freight Charge | Only, if there are Freight charges | Numeric | Total freight charge. Entered on Summary row. |

Field | Required | Value/Format | Location/Content/Restrictions |

Template Version | Yes | Uppercase I I.14 or I.15 | Provided on first line of the template. |

User ID | Yes | Not case sensitive | Info used to log into Service Automation. |

PIN | Yes | Numeric | IVR Pin number used to login to work orders. Can be found on work orders. |

Invoice # | Alphanumeric | You can use the work order number or a self generated alphanumeric combination. | |

Invoice Date | Yes | mm/dd/yyyy | Date cannot be before completion of work. |

TRACKING NUMBER | Yes | Numeric | On work order. |

Record Type | Yes | Record Type referrers to the information on a particular row and are always capital letters. Options are:

| N/A |

Skill Level | Yes, for Labor charges | Case Sensitive:

| Based on the worker type(s) that worked on the work order. Each Tech type must be entered on a separate row. |

Labor Type | Yes, for Labor charges | Case Sensitive:

| Based on the type of time worked. |

# Of Techs | Yes, for Labor charges | Numeric | Combined number of each type: Supervisors, Technicians and or Helpers who worked on the work order. Each Tech type must be entered on a separate row. |

Hourly Rate | Yes, for Labor charges | Numeric | Based on agreed upon amount listed in Service Provider’s Fixxbook account. See Client Rates in Fixxbook. |

Total Hours | Yes, for Labor charges | Numeric | Based on the combined number of hours for the “Tech” type. |

Labor Amount | Yes, for Labor charges | Numeric | Total hours for the Techs listed in the row. |

Travel Charge | Only if Travel Charges have been agreed upon | Numeric | Based on the Travel Charge agreed upon in Fixxbook. See Client Rates in Fixxbook. |

Material Description | Only if there are Material charges | Alpha | Description of Materials used on work order. Enter each “Material” used on a separate “M” line. |

Part # | Only if there are Material charges | Alphanumeric | The Part (Serial or Manufacturer) number. Enter each “Part” used on the corresponding “M” line. |

Price Per Unit | Only if there are Material charges | Numeric | Price for quantity of one. Enter each “Price Per Unit” used on the corresponding “M” line. |

Qty (Quantity) | Only, if there are Material charges | Numeric | Number of Parts used. Enter the “Qty” used on the corresponding “M” line. |

Material Amount | Only, if there are Material charges | Numeric | Total amount for Material. Each “material type” must be entered on a separate “M” line. |

Freight Charge | Only, if there are Freight charges | Numeric | Total freight charge. Entered on Summary row. |

Other Charges - Description | Only, if there are Other charges that do not fit into one of the other categories | Alpha | Enter either one of the following if applicable for your Client: Agreed Price, As Agreed, Credit Memo, Discount, Disposal, Management Fee, Markup, Overhead & Profit, Rental Fee, Shipping & Handling, or Subcontractor Cost. Enter each on a separate “L” line. |

Other Charges Amount | Only, if the are other charges | Numeric | Enter each on a separate “L” line. |

Invoice Tax | Only if it has been agreed that the Service Provider charges taxes for services rendered or materials. | Numeric | Invoice taxes should be entered in the Summary Record Type (S) row. |

Tax 2 | Only if it has been agreed that the Service Provider charges taxes for services rendered or materials. | Numeric | The invoice second tax amount, (typically GST for Canada). Multiple taxes are required for some Canadian Location. Invoice taxes should be entered in the Summary Record Type (S) row. |

Tax 2 Name | Only if it has been agreed that the Service Provider charges taxes for services rendered or materials. | Alpha | The second tax name for Canada: PST, QST or HST. The tax name is validated based on the location province:

Tax percentages in the International Line Item Invoice Templates are to be entered for each section separately in the Summary (S) row. They are: Labor Tax %, Trip Tax %, Material Tax %, Freight Tax %, and Other Charges Tax %. |

Invoice total | Yes | Numeric | Total of all charges. Invoice Totals should be entered in the Summary Record Type (S) row. |

Invoice Description | Yes | Alpha | Entered on (S) row. |

- On the Invoices List, click Download / Upload and select Upload Invoice Template.

- Click Browse a file and select the completed invoice template.

- Click Upload.

- Wait for the file to be validated.

- When the file processes, the Template Uploaded window appears. Click Download to check the report.

- If the template contains errors, the Validation Failed window appears. Click Download and open the report.

- Complete the required invoice template.

- Save it as an .xls formatted file.

- Email the file to invoices@servicechannel.net.

- An email will be sent to you indicating whether or not your invoice has been validated

Note: Only one file can be attached to each email.

What to expect after you submit the template

After you upload or email the completed invoice template, it will be validated and whether or not the labor rates submitted match the agreed upon amount(s). A validation report will be automatically generated. If the template was submitted by email, a download link will be sent to the email on file. Use that link to access the validation report. If there are errors, fix them and resubmit the template. If the invoice was submitted, via the upload modal, the validation will be available in the interface. Download it and if there are any errors, fix them and resubmit the invoice. If the invoice has a Labor Rate that is either above or below the agreed upon amount, then the system will open a modal indicating that the invoice validation has failed due to a Labor Rate Mismatch.

Troubleshooting Upload Errors

Should you run into errors, here is a list of errors that may help you resolve the issue. Fix the relevant information and then resubmit.

Error Message | Description |

|---|---|

Invalid Template Version Supported Vers. | Template version #' field is set incorrectly |

No Pin | Pin' field is blank |

Pin is not numeric value | Pin' field has any value except numeric |

Template version {0} for selected location '{1}' is not allowed. | Template version is not allowed for selected location (for ex. when 15 template version is chosen for US / Canada location) |

Invalid Other Charges Qty | Other Charges Qty is not a number or is a number but not formatted correctly |

Invalid Other Unit Cost | Other Charges Unit Cost is not a number or is a number but not formatted correctly |

Invalid Other Charge Description | Other Charges Charge Description is not formatted correctly |

Invalid Labor Tax Percentage | Labor Tax Percentage' field is invalid: a) Value is not a number b) Value is a number but not formatted correctly |

Invalid Travel Tax Percentage | Travel Tax Percentage' field is invalid: a) Value is not number b) Value is a number but not formatted correctly |

Invalid Material Tax Percentage | Material Tax Percentage' field is invalid: a) Value is not a number b) Value is a number but not formatted correctly |

Invalid Freight Tax Percentage | Freight Tax Percentage' field is invalid: a) Value is not a number b) Value is a number but not formatted correctly |

Invalid Other Charge Tax Percentage | Other Charge Tax Percentage' field is invalid: a) Value is not a number b) Value is a number but not formatted correctly |

Invalid Labor Tax | Labor Tax' field is invalid: a) Value is not a number b) Value is a number but not formatted correctly |

Invalid Travel Tax | Travel Tax' field is invalid: a) Value is not a number b) Value is a number but not formatted correctly |

Invalid Material Tax | Material Tax' field is invalid: a) Value is not a number b) Value is a number but not formatted correctly |

Invalid Freight Tax | Freight Tax' field is invalid: a) Value is not a number b) Value is a number but not formatted correctly |

Invalid Other Charge Tax | Other Charge Tax' field is invalid: a) Value is not a number b) Value is a number but not formatted correctly |

Invalid Total | Total is invalid: a) Total column is not a number b) is number but not formatted correctly c) Total is not equal to (Labor Total + Trip Charge + Material Total + Freight Charge + Other Charge + Tax) |

OK (ID={0}) | Invoice is generated successfully. It has record ID = {...} |

Empty Other Charge Description | Other Charge Description' field is blank though some 'Other Charges' is chosen |

There are more than one Summary lines for the invoice | An invoice has 2 or more "S" lines |

Invalid Record Type | Record Type is invalid: a) the field is blank; b) has any value except "L", "T", "M", "S"; c) value name is "L" / "T" / "M" / "S", but it is set incorrectly (for ex. "L" record type for "S" line info) |

Invoicing is disabled | Invoicing is disabled |

Invalid Tax | Tax is invalid |

Invalid Tax2 | Tax2 is invalid |

Err:Total is null | Total is null |

Err:This invoice is set to auto-invoice | The invoice is set to auto-invoice (the WO has Auto-invoice checked in the settings) |

Err:Electronic Signature Agreement Required | Electronic Signature Agreement is required |

Err:Work order not found | Work Order is not found |

Err:Wrong Work Order currency | Work Order currency is incorrect |

Err:Work order currency not found | Work Order currency is not found |

Err:Invoicing disabled | Invoicing is disabled for the user |

Resolution text required in Invoice Text field | Invoice Text' field is blank though the field is required according to settings |

Resolution text required in Text field | Text' field is blank though the field is required to settings |

Resolution text required in Invoice Description field | Invoice Description' field is blank though the field is required to settings |

Below are a few important notes to remember when submitting the invoice template:

- Work orders must have status COMPLETED and the extended status should be either CONFIRMED or No Extended Status.

- None of the column names can be changed. If they are changed, you will receive errors when submitting your invoice.

- No blank rows are allowed between invoices on the template.

- The template versions begin with the letter I (uppercase for i).

- Money values in a template shouldn't have more than 2 digits after a point.

- Tax values will be rounded to 2 digits after a point.

- Empty money values in a template are treated as 0 [zero].

- If an invoice has an incorrect tax, the invoice will still be created, but it will be in a disputed state.

- Be sure to save your file as Compatible 97-2003 XLS format.

- Do NOT reply to the ServiceChannel Invoices email address.

Complete List of Invoice Templates and Error Codes

- I.14 (Canadian and US Clients).xls (20 KB)

- I.15 (International).xls (20 KB)

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page: