Multiple GL Codes per Invoice

Maria Tarnopolskaya (Unlicensed)

Sometimes one GL code per invoice is not enough if you need to track individual labor, material, or other invoice costs. In this case, along with the main GL code, you can set multiple approval codes for one invoice by adding a specific code for each charge type or line item.

To enable this feature, contact your Customer Success Manager.

Line-item GL codes are available for the trades and categories specified in the Admin > Invoices > General > Require Line Items section.

Viewing Line-Item GL Codes

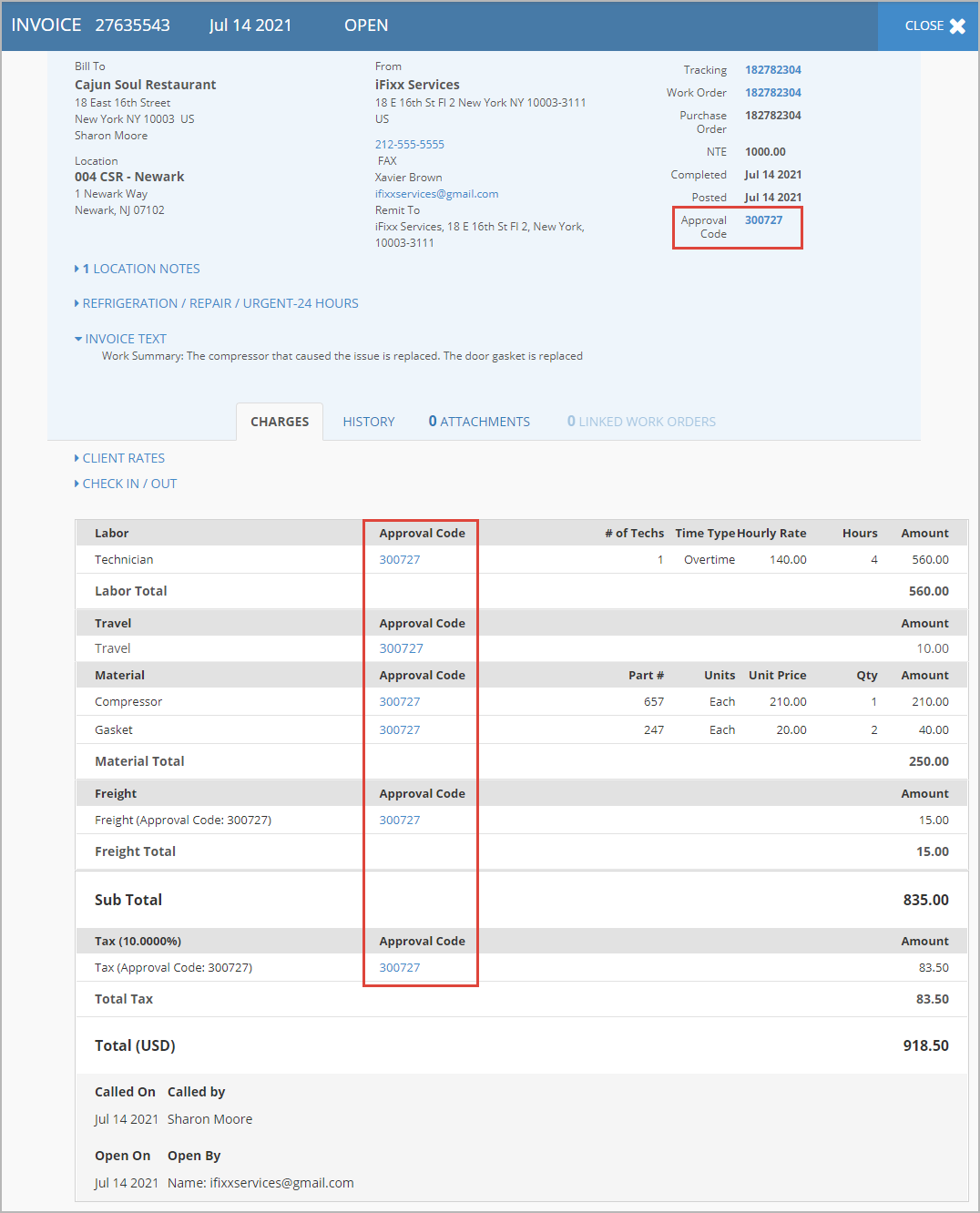

The GL code added to a work order is automatically set as a default for the whole invoice and for each charge type or line item.

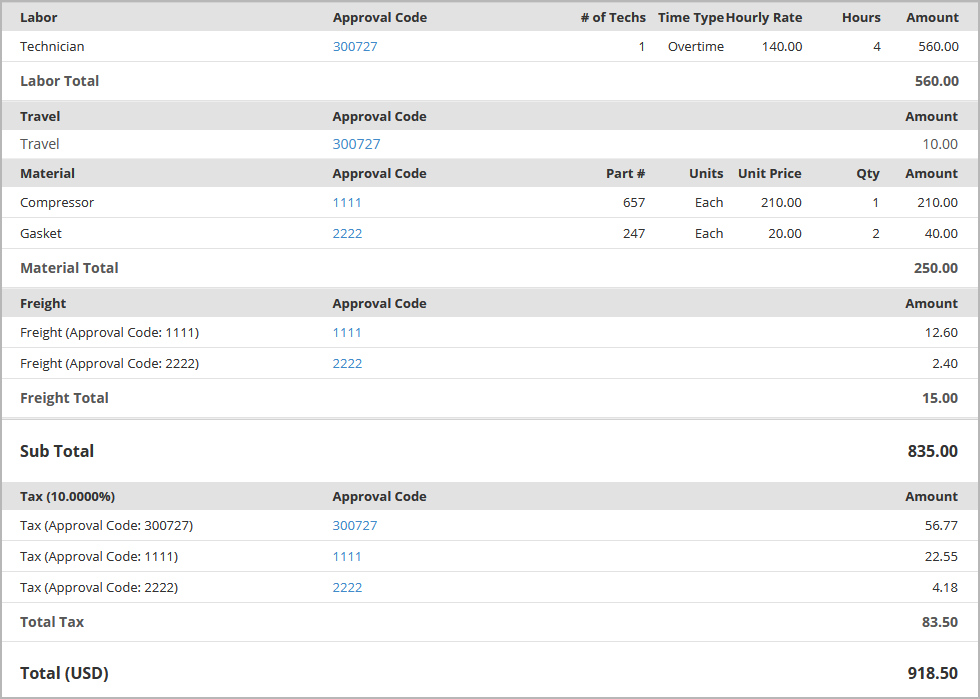

To view the line-item GL codes, open the Invoice Details page, and find them next to each charge type or line item.

You can manually edit GL codes for any of the charge types or line items.

On the Invoices List, you can search for invoices by line-item GL codes.

Editing Line-Item GL Codes

To edit line-item GL codes, you need to have the same permissions as for editing the main approval code.

MLI users should have the Can Change Code option selected for them in their MLI Level settings.

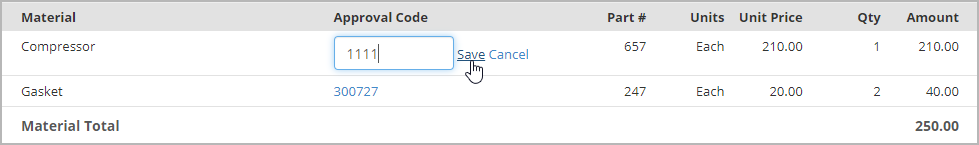

- Under the Charges tab of the Invoice Details view, click the GL code in the charge type or line item you want to edit.

- Enter a new code.

- Click Save.

The new GL code is saved.

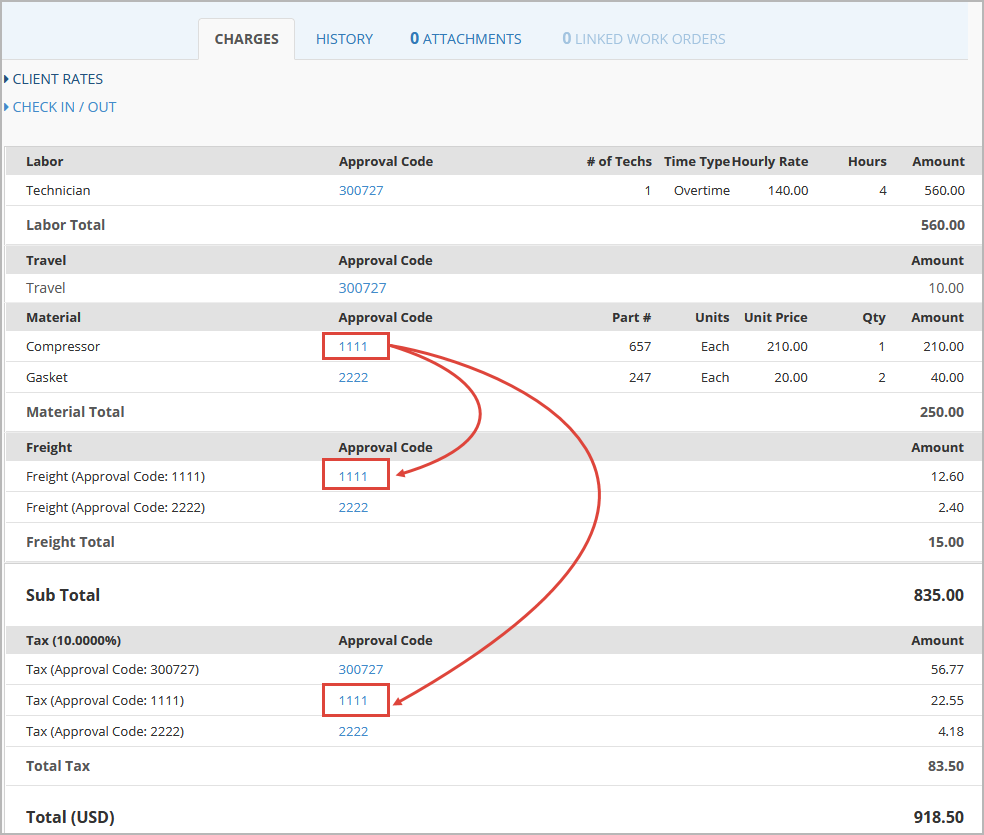

The corresponding lines are also added to the Freight and Tax sections.

Freight includes only the GL codes specified in the Material section, while there is a Tax line for each approval code specified in the invoice.

Note

- Changing the main GL code on the invoice will change all the line-item GL codes to this new code, and all the updates you have made to the line items will be lost.

- Changing the Category that has another GL code associated with it will set this new code for all the line items.

Freight and Tax Calculation

Freight amount is calculated based on the Material GL codes percentage. Tax is calculated based on all the GL codes — Labor, Travel, Material, Freight, Other — included in the invoice.

Freight

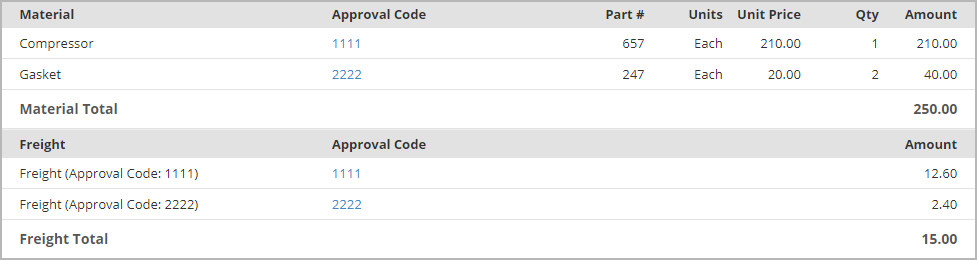

In the example above, the Material breakdown includes two different line-item GL codes: 1111 and 2222.

The amount per each Freight line is auto-calculated from Freight Total split proportionally between the GL code amounts of the Material section. The Freight Total is the Freight amount the provider specified when creating the invoice.

| GL Code | Material | Amount, $ | Percentage, % | Freight, $ |

|---|---|---|---|---|

| 1111 | Compressor | 210.00 | 84 | 15 * 0.84 = 12.60 |

| 2222 | Gasket | 40.00 | 16 | 15 * 0.16 = 2.40 |

| Total | 250.00 | 100 | 15.00 |

Tax

Tax Includes three GL codes: 300727, 1111, and 2222. The amount per each Tax line is auto-calculated from Total Tax split proportionally between the GL code amounts. The Total Tax is the Tax amount the provider specified when creating the invoice.

| GL Code | Including | Amount, $ | Percentage, % | Tax, $ |

|---|---|---|---|---|

| 300727 | Labor + Travel | 570 | 68 | 83.50 * 0.68 = 56.78 |

| 1111 | Material (Compressor) + Freight (Approval Code: 1111) | 222.60 | 27 | 83.50 * 0.27 = 22.545 |

| 2222 | Material (Gasket) + Freight (Approval Code: 2222) | 42.40 | 5 | 83.50 * 0.05 = 4.175 |

| Total | 835 | 100 | 83.50 |

When the sum of line item amounts after rounding does not add up to the total amount, the variance is added or subtracted automatically from the first line item to make it balanced. This is applicable if the variance is less than $1.

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page: