Charges in the Line Item Invoice Template

Anastasia Medovkina (Deactivated)

This is the second step of completing the line item invoice template. Move to this step after you have filled out the Invoice Template Number, User ID, PIN, Invoice Number, Date, and work order Tracking Number.

Completing Charges in the Line Item Invoice Template

Since the Line Item Invoice Template allows you to add line items for labor, material, and other charges, you need to identify which record type applies to which line item. The Record Type field identifies if a spreadsheet row is for line items or for a summary.

.png?version=1&modificationDate=1644838407626&cacheVersion=1&api=v2&width=500&height=311)

- Enter the Record Type. Enter the following letter based on the type of charges you need to itemize:

- L for Labor Line Items

T for Travel Line Items

Use this record type only when your client asks you to break down travel costs. Otherwise, add the travel charges’ total amount to the Summary Record Type (S) row.

- M for Material Line Items

O for Other Line Items

Use this record type only when your client asks you to break down other costs. Otherwise, add the other charges’ total amount to the Summary Record Type (S) row.

- S for Summary

.png?version=1&modificationDate=1644838749487&cacheVersion=1&api=v2&width=600&height=314)

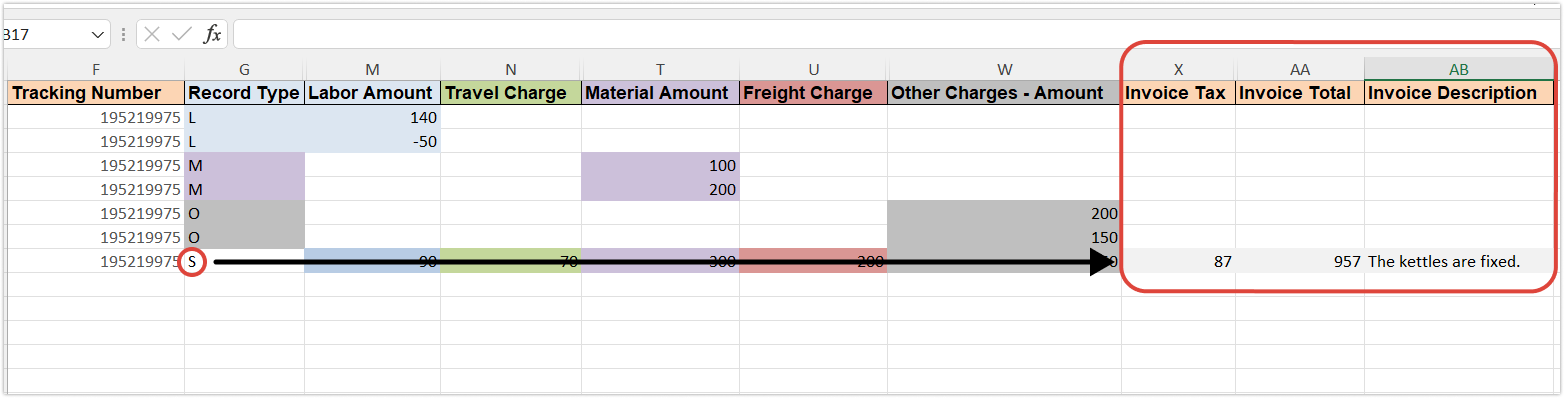

Each line item invoice must have only one Summary Record Type (S) row. This row is used to specify the following:

- The total amount of labor, travel, material, and other charges

- Travel charge (for the I.14, I.15 line item template versions only)

- Freight charges

- Tax amount, invoice total amount, and invoice description

Add the summary row only after itemizing labor, travel, material, and other charges.

.png?version=1&modificationDate=1644838811239&cacheVersion=1&api=v2&width=900&height=145)

- Enter labor charges. It can be entered either as a lump sum or can be broken into one or multiple line items:

- Enter a lump sum in the Summary Record Type (S) in the Labor Amount column.

- To enter this charge as a line item, read Labor, Travel, and Material Charges...

- Enter travel charges. It can be entered either as a lump sum or can be split into one or multiple line items:

- Enter a lump sum in the Summary Record Type (S) in the Travel Charge/Amount column.

- To enter this charge as a line item, read Labor, Travel, and Material Charges...

- Enter material charges. It can be entered either as a lump sum or can be split into one or multiple line items:

- Enter a lump sum in the Summary Record Type (S) in the Material Amount column.

- To enter this charge as a line item, read Labor, Travel, and Material Charges...

- Enter other charges. They can be entered either as a lump sum or can be split into one or multiple line items. Read the article Completing the Other Charges... to complete this charge as a lump sum or a line item one.

Enter freight charges in the Summary Record Type (S) row in the Freight Charge column.

The following picture shows amounts in the Summary Record Type (S) for all the charges separately..png?version=1&modificationDate=1644839055045&cacheVersion=1&api=v2&width=900&height=150)

All charges in the Summary Record Type (S) may have negative amounts (-N) if necessary.

.png?version=1&modificationDate=1644839095908&cacheVersion=1&api=v2&width=600&height=253)

To ensure successful invoice validation for invoices uploaded to ServiceChannel via the line-item template, make sure that the items listed in the template match those on the Negotiated Price List.

Enter the invoice tax amount in the Summary Record Type (S) in the Invoice Tax (in numbers) column.

Click here to see more information about the additional taxes columns for Canada:Tax 2. The invoice second tax amount (typically GST for Canada). Multiple taxes are required for some Canadian locations.

Tax 2 Name. The second tax name for Canada: PST, QST, or HST. The tax name is validated based on the location province:- Alberta (AB): GST

- British Columbia (BC): GST or PST

- Manitoba(MB): GST or PST

- New-Brunswick (NB): HST

- Newfoundland and Labrador (NL): HST

- Northwest Territories (NT): GST

- Nova Scotia (NS): HST

- Nunavut (NU): GST

- Ontario (ON): HST

- Prince Edward Island (PE): HST

- Quebec (QC): GST or QST

- Saskatchewan (SK): GST or PST

- Yukon (YT): GST

Click here to see the information on how to enter tax percentages in the International Line Item Invoice Template:Enter Tax percentages in the International Line Item Invoice Templates for each section separately in the Summary Record Type (S) row. They are: Labor Tax %, Trip Tax %, Material Tax %, Freight Tax %, and Other Charges Tax %.

.png?version=1&modificationDate=1644839196959&cacheVersion=1&api=v2&width=600&height=140)

- Enter the invoice total in the Summary Record Type (S) row in the Invoice Total column. It is a required field.

- Enter the invoice description in the Summary Record Type (S) row in the Invoice Description column. The detailed description of the work completed/findings would be in your own invoice form. This may be required based on each of your client's configurations.

- Save your file in the Compatible 97-2003 XLS format.

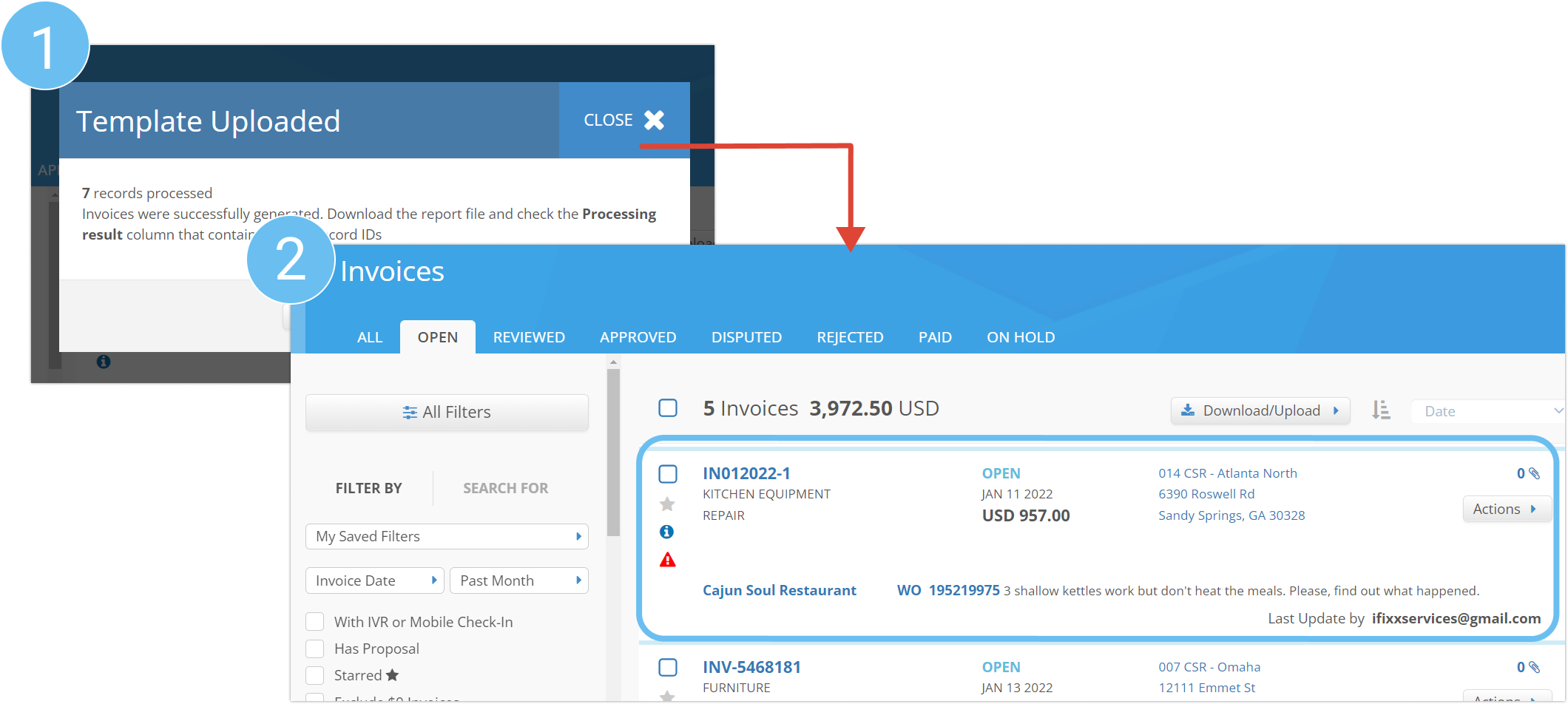

- In the Invoices tab, click the Download/Upload button.

- Click the Upload Invoice Template button from the drop-down menu. The Upload Your Invoice Template overlay appears.

- In the Upload Your Invoice Template overlay, click the Browse a file button.

.png?version=1&modificationDate=1644839273046&cacheVersion=1&api=v2&width=600&height=288)

- Choose the invoice template you have created.

- Click the Upload button. Once you submit the Line Item Template, one or several invoices are created in Provider Automation.

If you entered the amount which is higher or lower than the agreed-upon amount, you will see a warning icon showing that there is a rate mismatch. Read more about the Reasons for Rates Mismatch.

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page: