Manage Financial Information

Maria Tarnopolskaya (Unlicensed)

Anastasia Medovkina (Deactivated)

The Financial Info page in Provider Automation allows you to manage pertinent financial forms and information. This is beneficial because you do not have to send physical copies of this information to your ServiceChannel clients, as those who require it can review it securely in your profile.

We recommend that you complete and keep up to date all sections of the Financial Info page, as ServiceChannel clients may require you to complete them for payment processing.

- In Provider Automation, under the menu, click Administration > Financial Information. The Financial Info page appears.

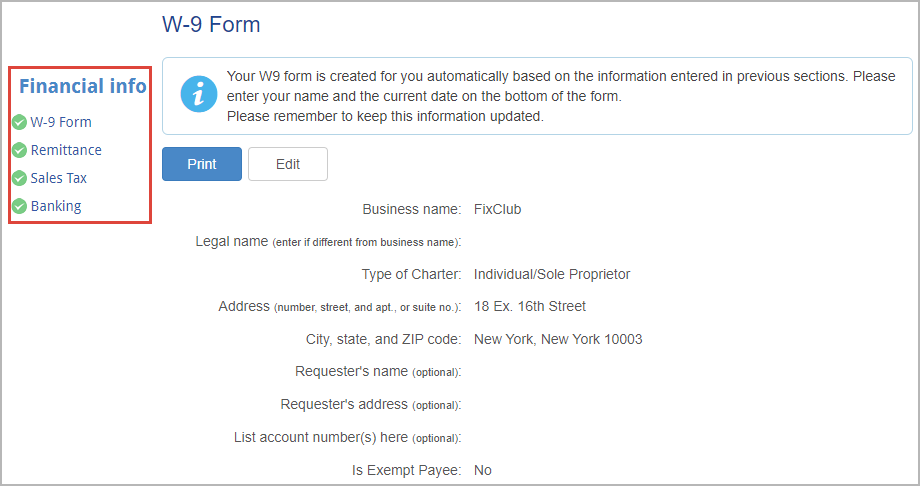

There are 4 financial forms:

W-9 Form: Completing this IRS form allows your ServiceChannel clients to review and print it at anytime. ServiceChannel clients may print a copy of the form in the official IRS format, as needed, without you mailing or faxing a physical, paper form.

- Remittance: As your Business Profile is linked to Service Automation, your remittance address is pulled from your Profile into Service Automation invoices. You may manage which remittance address appears on those invoices.

- Sales Tax: Entering and managing this data alerts your clients that you collect and remit taxes, and that your tax information is compliant with state and local laws.

- Banking: The banking section of Client Requirements is used to collect information, so a client can pay you for work done in Service Automation. Only clients that enroll in ServiceChannel’s Payment Manager will use this requirement. Clients that do not use Payment Manager will request the information in another way.

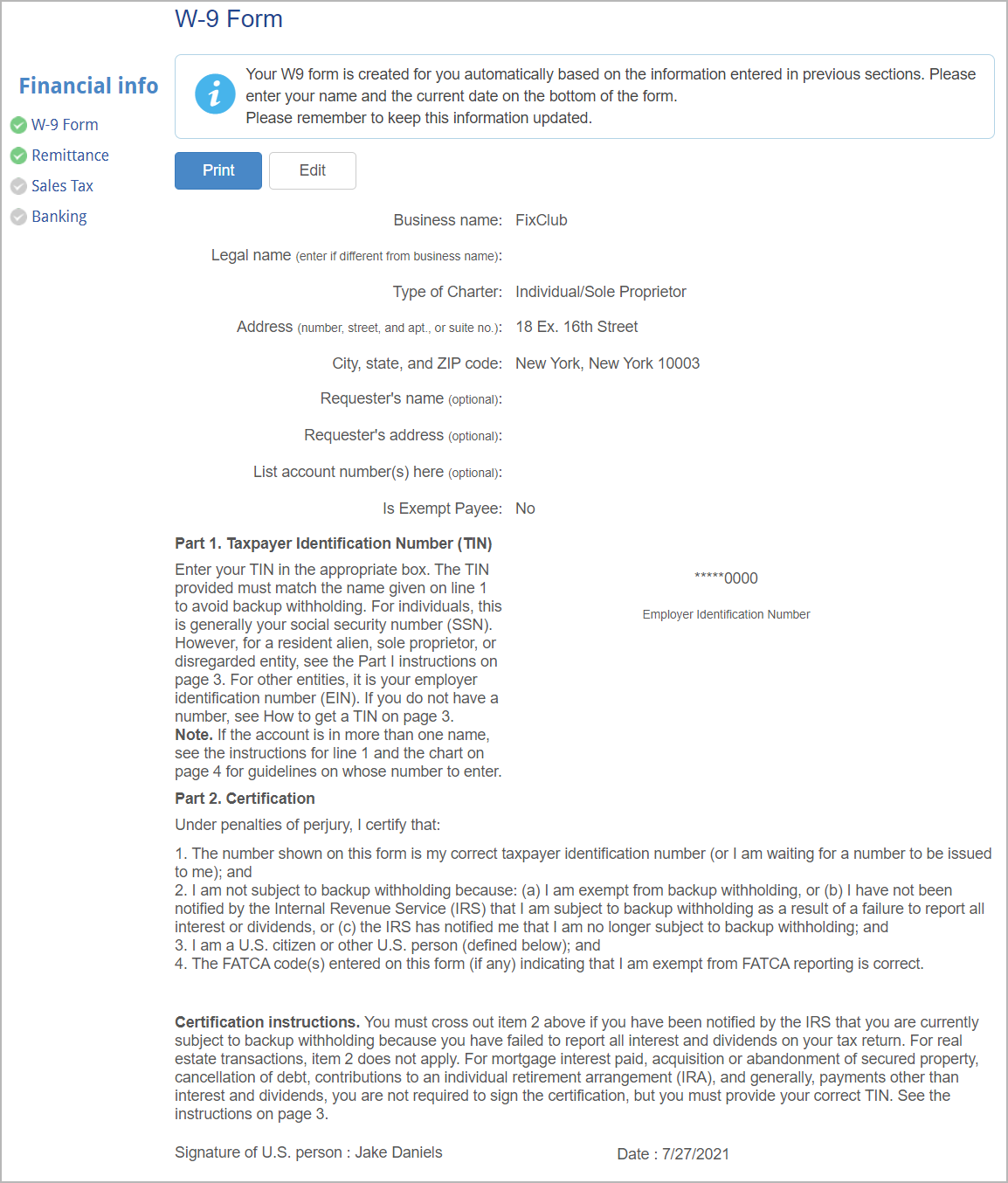

Managing the W-9 Form

You may add or edit any information on your W-9 form, in compliance with IRS rules.

You must complete the Business Information section of your profile before completing W-9 information as your Business Name, Type of Charter, Address and Tax ID Number/ EIN / SSN are pulled from that section. Completing the W-9 Form before the Company Information section will result in a system error.

- Click Edit. The Edit W9 Form overlay appears with your Company Information pulled from your Profile.

(Optional) Enter your Legal name, Requester’s name and address, and Account number(s), where applicable.

Once you are accepted into at least one client network, your Company Name and Tax ID cannot be edited through this method. You should contact our Support team to edit this information.

- Indicate whether you are an Exempt Payee.

- Under Part 2. Certification, in step 2, indicate your backup withholding status.

- At the bottom of the form, enter your Signature and today's Date.

- Click Save.

The W-9 form appears with the updated information.

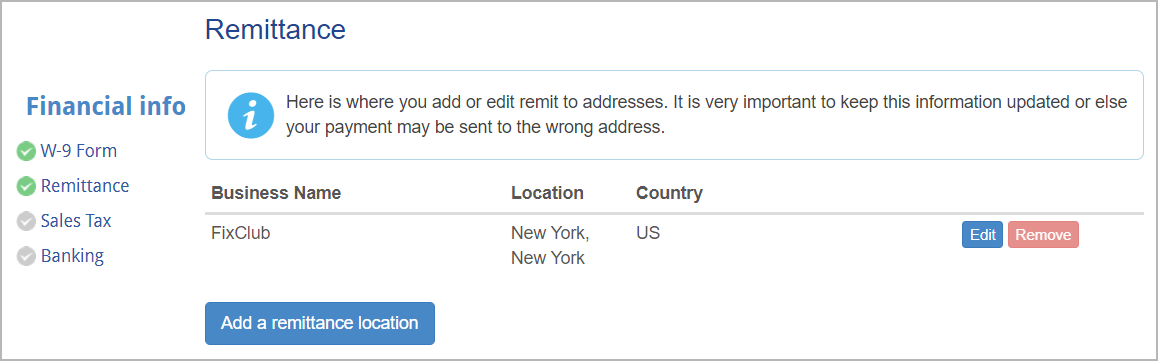

Managing Remittance

It is very important to keep this information updated or your client may send payment to the wrong address. You may add as many remittance addresses as needed and when invoicing in Service Automation all remittance addresses will be available to select from.

Remittance Payment Types

Payment type allows you to indicate to your ServiceChannel clients all accepted forms of payment. You may add up to six payment types per remittance location.

- On the left navigation menu, click Remittance. The Remittance page opens.

- Click Add a Remittance Location.

- Enter your Business Name, Address, Phone, and Email, as required.

- Click Save.

The remittance location is listed on the page. - Repeat steps 2–4 for every remittance location.

Some clients will require remittance address changes be approved by them before taking effect in the system. When your client requires this, edits you make to your remittance will be placed in the pending status until approved by your client.

- On the left navigation menu, click Remittance. The Remittance page opens.

- Click Edit next to the desired remittance location. The Edit Remittance Location overlay appears.

- Modify the desired fields.

- Click Save. The list will populate with the modified remittance location.

- On the left navigation menu, click Remittance. The Remittance page appears.

- Click Remove next to the desired remittance location. The Remove Remittance Location overlay appears.

- Click Remove. The remittance location is removed from the list.

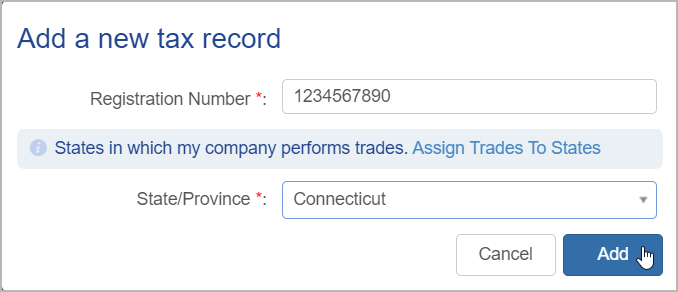

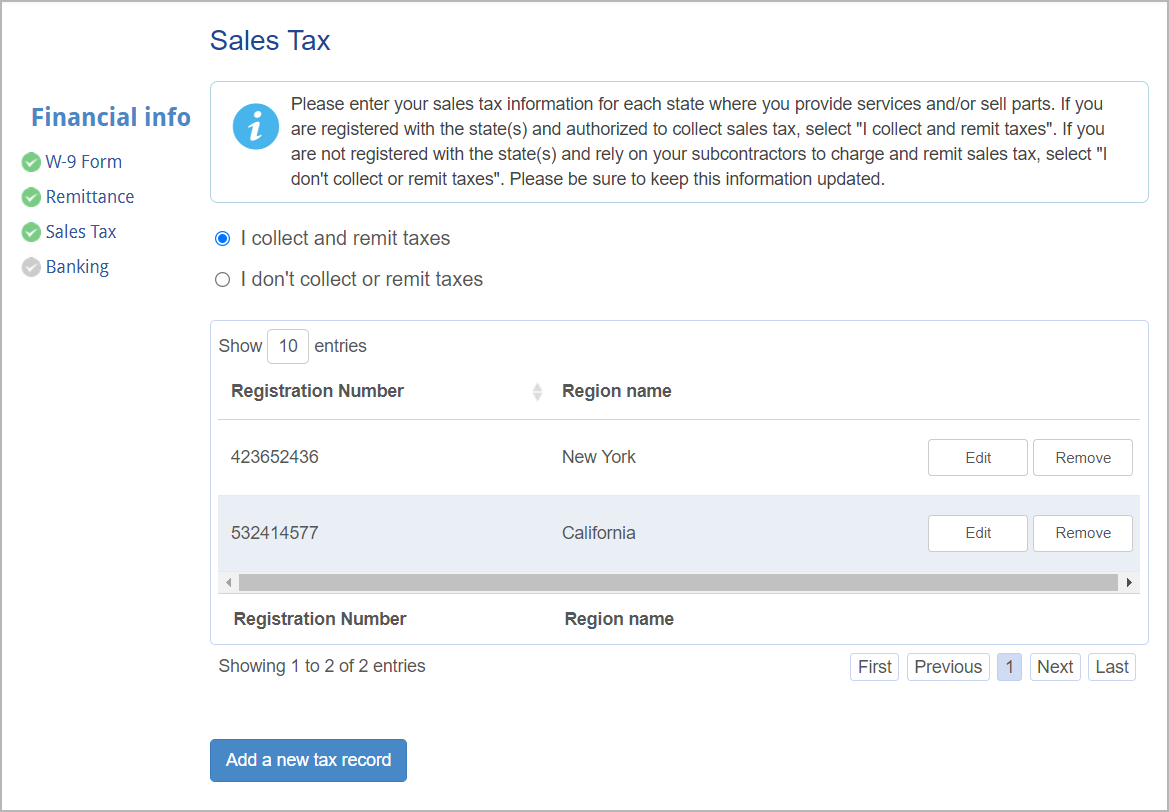

Managing Sales Tax

You may add, edit or delete any information about your sales tax, as needed.

- On the left navigation menu, click Sales Tax.

- Indicate whether you do or do not collect and remit sales tax.

- To collect and remit sales tax:

- Click Add a New Tax Record.

Enter a Registration Number and select a State/Province from the drop-down list.

If your states/provinces are not listed, click Assign Trades to States to complete assigning your trades to regions.

- Click Add. The tax record lists on the page.

- Repeat steps 2.a.i–2.a.iii to list all sales tax records.

To indicate that you do not collect sales tax:

- Click I don't collect or remit taxes.

- To collect and remit sales tax:

- On the Financial Info page, click Sales Tax. The Sales Tax page appears.

- Click Edit next to the desired sales tax record. The Edit tax record overlay appears.

- Modify the desired fields.

- Click Save. The updated sales tax record appears in the list.

- On the Financial Info page, click Sales Tax. The Sales Tax page appears.

- Click Remove next to the desired sales tax record. The remove sales tax record overlay appears.

- Click Remove. The sales tax record is removed from the list.

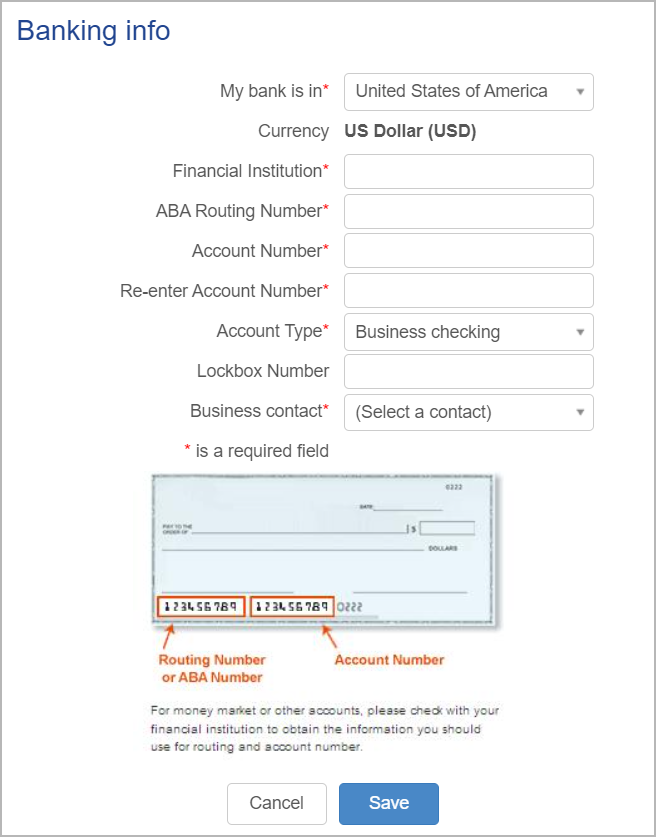

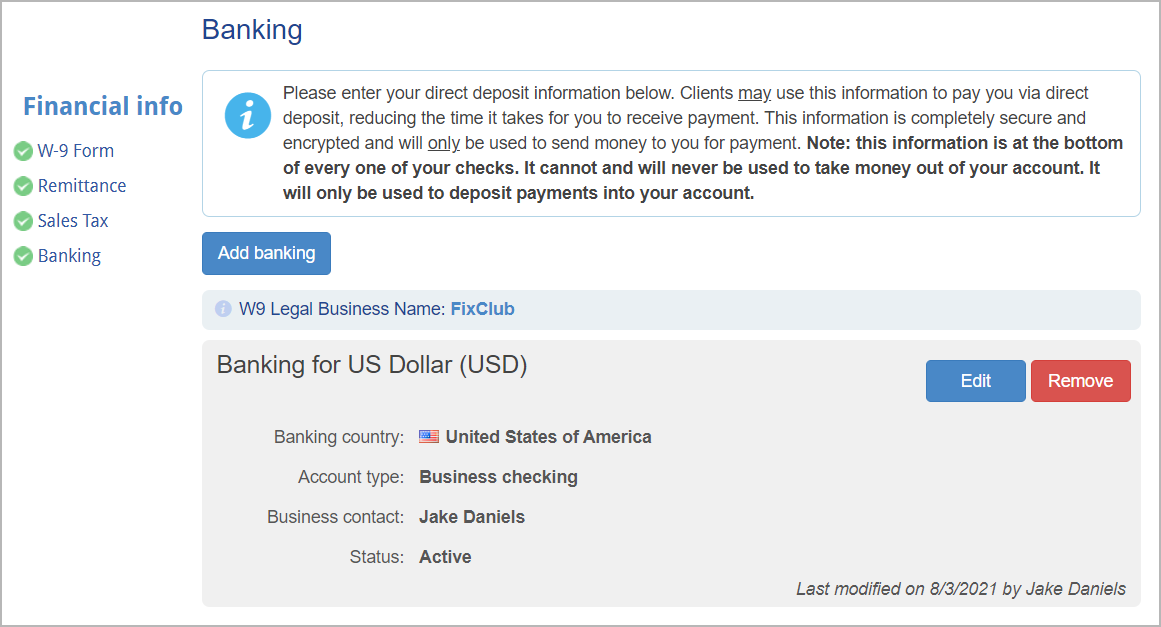

Managing Banking

It is very important to keep your direct deposit information so clients can use this information to pay you via direct deposit. It will reduce the time it takes for you to receive payment.

The banking section of Client Requirements is used to collect information, so a client can pay you for work done in Service Automation. Only clients that enroll in ServiceChannel’s Payment Manager will use this requirement. Clients that do not use Payment Manager will request the information in another way.

You can have only one banking record setup for each country.

- On the left navigation menu, click Banking. The Banking page opens.

Click Add Banking. The Banking Info overlay appears.

- Complete all the required fields, and click Save.

Your banking information has been added to your profile.

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page: