Adding Financial Information

Maria Tarnopolskaya (Unlicensed)

Anastasia Medovkina (Deactivated)

Chellie Esters

Adding your Financial Information in Provider Automation ensures that you can do business with ServiceChannel clients. Here you can manage the financial information that clients need for operational purposes, and that makes invoicing and collecting payment faster and easier.

There are two sections to complete:

- Financial Information, which includes W-9 Form, Remittance, Sales Tax, and Banking.

- My Account, which includes adding a payment method for ServiceChannel Usage Fees.

Section 1. Adding Financial Information

Financial information consists of a W-9 Form, Remittance for invoicing, Sales Tax registration, and Banking. This section is visible to clients who invite you into their Network.

- On the top navigation bar, click Profile.

- Next to Financial Information, click View Financial Information.

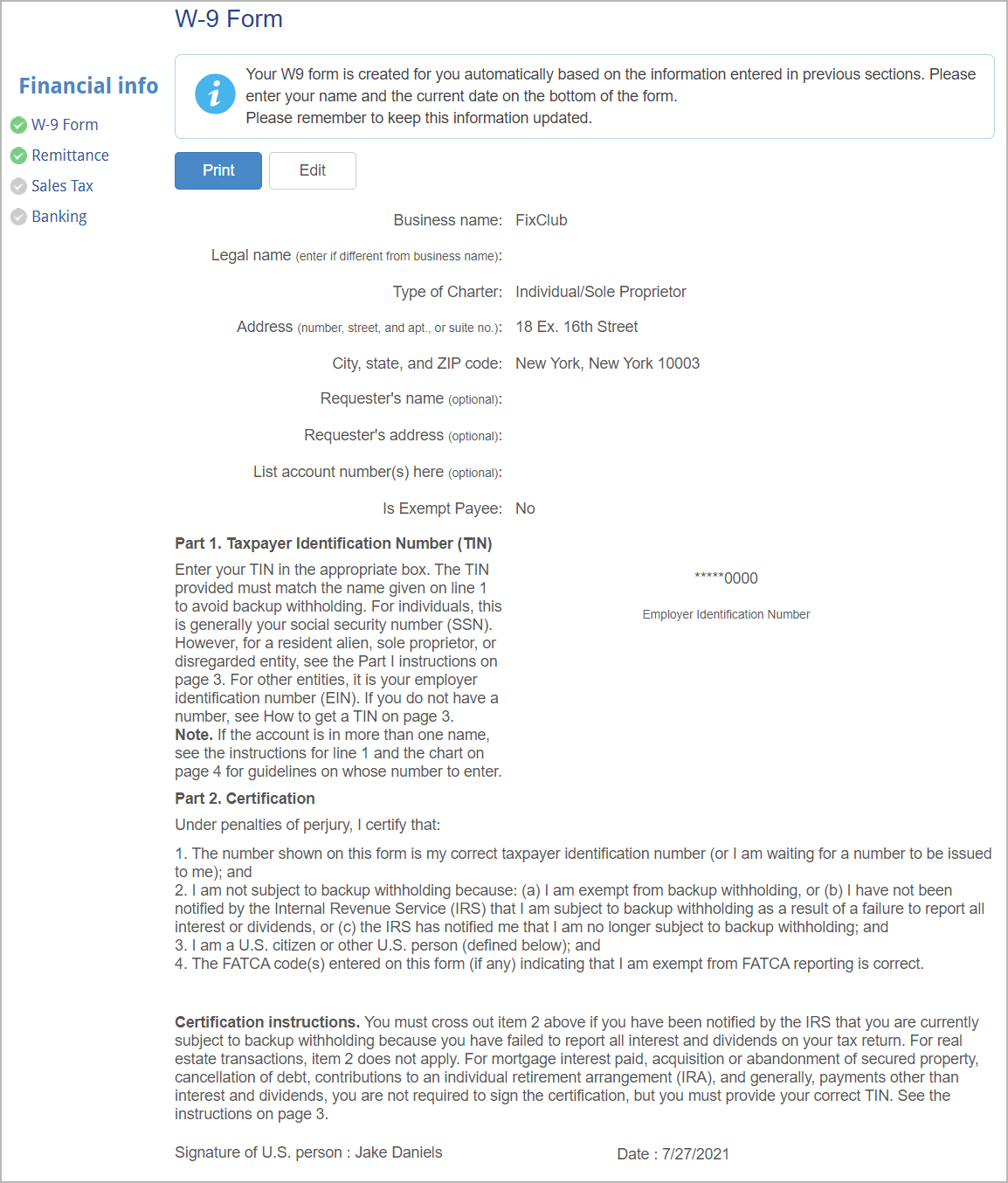

W-9 Form

- Click Edit. The Edit W9 Form overlay appears with your Company Information pulled from your Profile.

(Optional) Enter your Legal name, Requester’s name and address, and Account number(s), where applicable.

Once you are accepted into at least one client network, your Company Name and Tax ID cannot be edited through this method. You should contact our Support team to edit this information.

- Indicate whether you are an Exempt Payee.

- Under Part 2. Certification, in step 2, indicate your backup withholding status.

- At the bottom of the form, enter your Signature and today's Date.

- Click Save.

The W-9 form appears with the updated information.

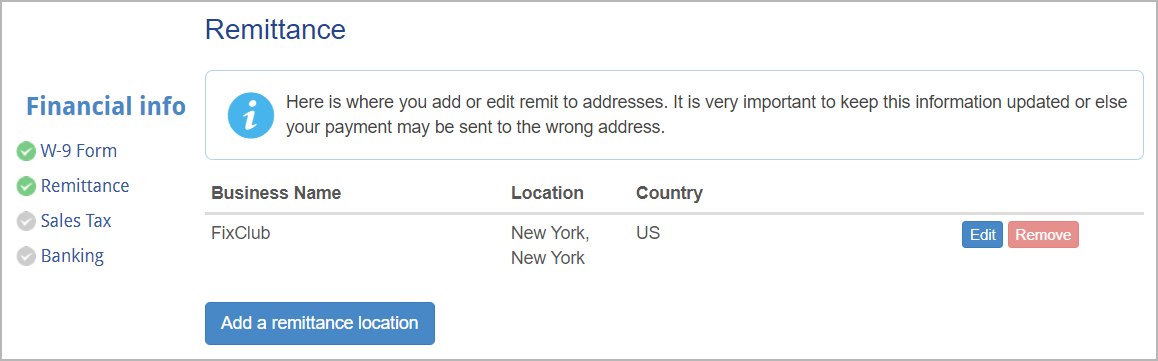

Remittance

- On the left navigation menu, click Remittance. The Remittance page opens.

The remittance location has been auto-filled with your company headquarters information. (Optional) Click Edit to update the remittance location information if needed. In the overlay that appears, make necessary changes, and click Save.

You cannot delete the only remittance location. The Remove button is disabled unless you add another remittance location.

- Click Add a Remittance Location.

- Enter your Business Name, Address, Phone, and Email, as required, and then click Save. The remittance location is listed on the page.

- Repeat steps 3–4 for every remittance location.

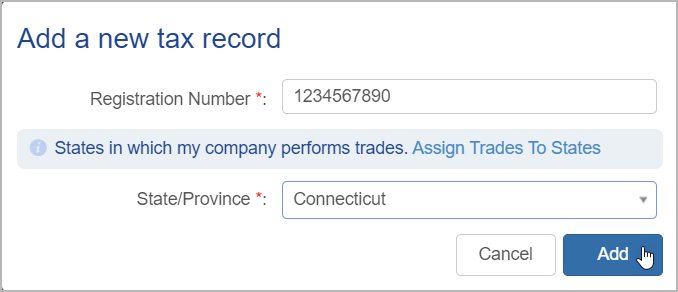

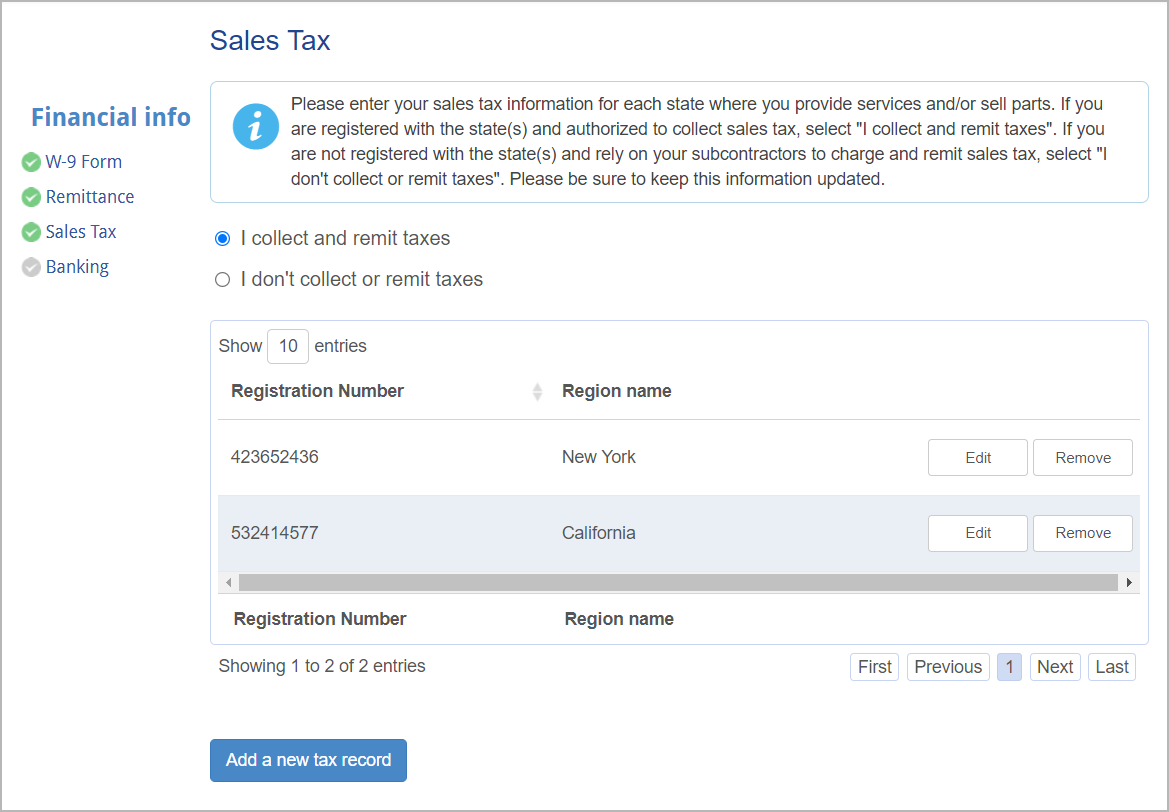

Sales Tax

- On the left navigation menu, click Sales Tax.

- Indicate whether you do or do not collect and remit sales tax.

- To collect and remit sales tax:

- Click Add a New Tax Record.

Enter a Registration Number and select a State/Province from the drop-down list.

If your states/provinces are not listed, click Assign Trades to States to complete assigning your trades to regions.

- Click Add. The tax record lists on the page.

- Repeat steps 2.a.i–2.a.iii to list all sales tax records.

To indicate that you do not collect sales tax:

- Click I don't collect or remit taxes.

- To collect and remit sales tax:

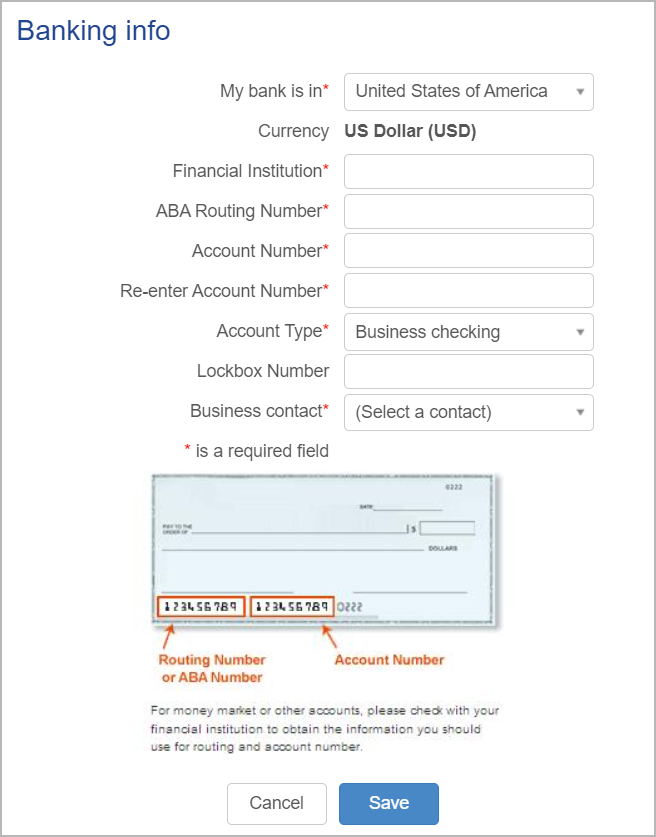

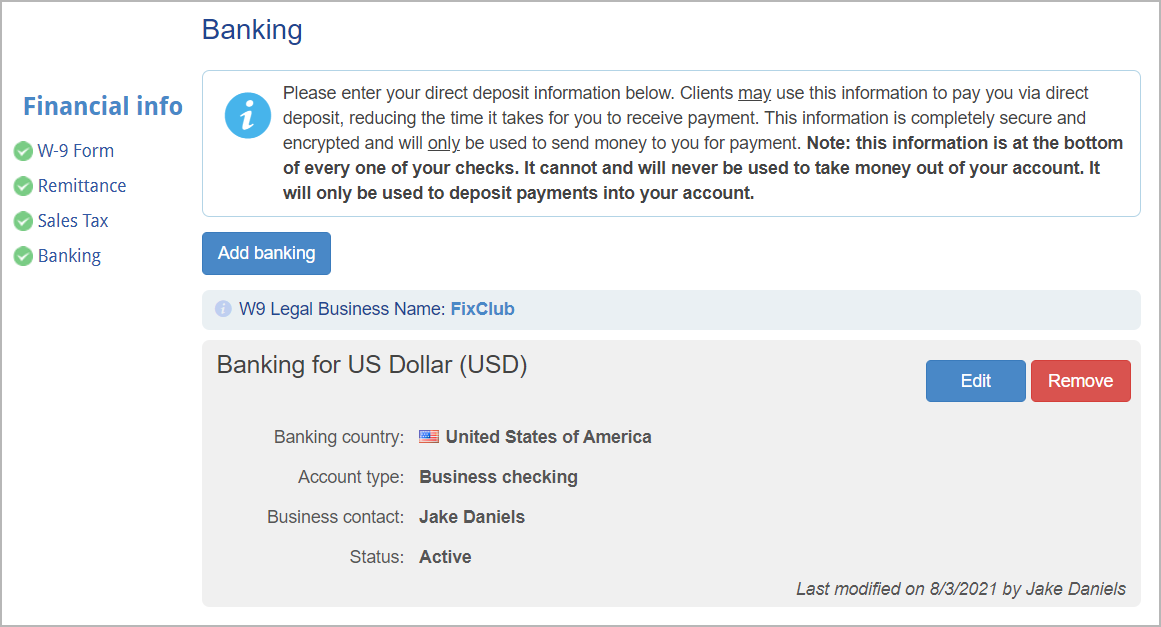

Banking

The banking section of Client Requirements is used to collect information, so a client can pay you for work done in Service Automation. Only clients that enroll in ServiceChannel’s Payment Manager will use this requirement. Clients that do not use Payment Manager will request the information in another way.

You can have only one banking record setup for each country.

- On the left navigation menu, click Banking. The Banking page opens.

Click Add Banking. The Banking Info overlay appears.

- Complete all the required fields, and click Save.

Your banking information has been added to your profile.

Section 2. Completing My Account

Under My Account, add payment methods to your Provider Automation account.

You can use the Business Profile section of Provider Automation for free. Once your profile is complete, potential clients can find and invite you into their networks to do business at no charge.

Once your clients start doing business with you, ServiceChannel charges all providers a nominal usage fee for each pre-tax amount of approved invoice: one and a quarter percent (1.5%) per approved invoice with a maximum of $4.00 per approved invoice.

These small fees help us bring you Provider Automation, our mobile application, and various benefits and services. Please see ServiceChannel Usage Fees for more information.

Important

It is important to complete My Account in order to invoice your clients. You will not be charged until your clients approve your invoices.

- In the top-left corner of the page, click the menu icon, and then Administration > My Account. The Terms & Conditions page appears.

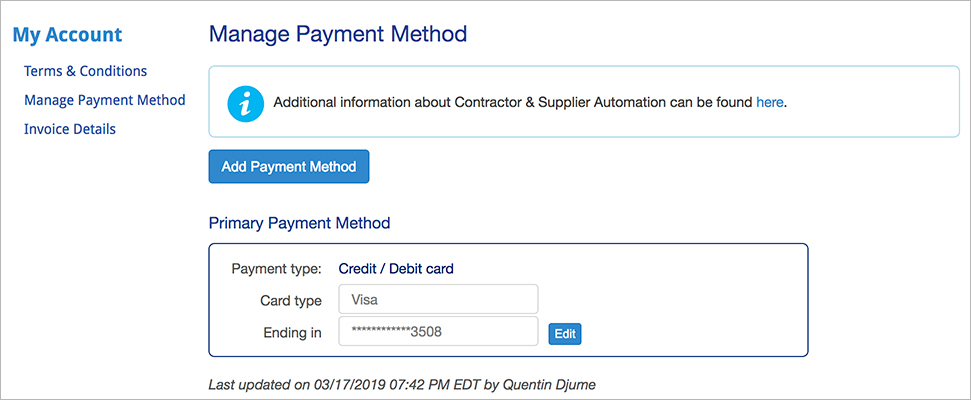

- On the left navigation menu, click Manage Payment Method.

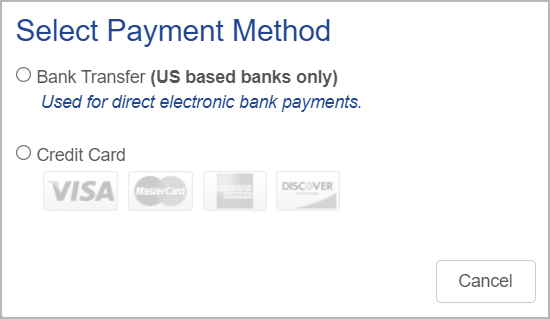

- Click Add Payment Method. The Select Payment Method overlay appears.

- Select either Bank Transfer or Credit Card.

- Select Bank Transfer to pay by Electronic Funds Transfer (eCheck Direct Debit) from a bank account.

- Select Credit Card to pay by accepted credit/debit card.

Complete all the required fields.

Important

- Enter the name exactly as it appears on the card. Pay close attention to middle names/initials and the company name.

- Enter the address exactly as it appears on the monthly statement. Pay close attention to abbreviations such as "St." vs. "Street", "Ave." vs. "Avenue" and "Blvd." vs. "Boulevard".

Click Authorize Payment if you selected Bank Transfer in step 4, or Submit if you picked Credit Card.

Authorize.net will verify your banking information or your credit card information to ensure accuracy.ServiceChannel is an Authorize.net valued merchant, meaning the best in safety and security of financial data. Authorize.Net is committed to providing its merchant customers with the highest level of transaction processing security, safeguarding customer information and combating fraud.

- When Authorize.net has completed payment authorization, you will receive a confirmation message. Click OK.

Your payment method is listed on the page as the Primary Payment Method.

Next, review your financial information in your profile.

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page: