- Created by Uma Srinivasan (Unlicensed) , last modified by Anastasia Troichuk (Unlicensed) on Jan 10, 2020

You are viewing an old version of this content. View the current version.

Compare with Current View Version History

« Previous Version 11 Next »

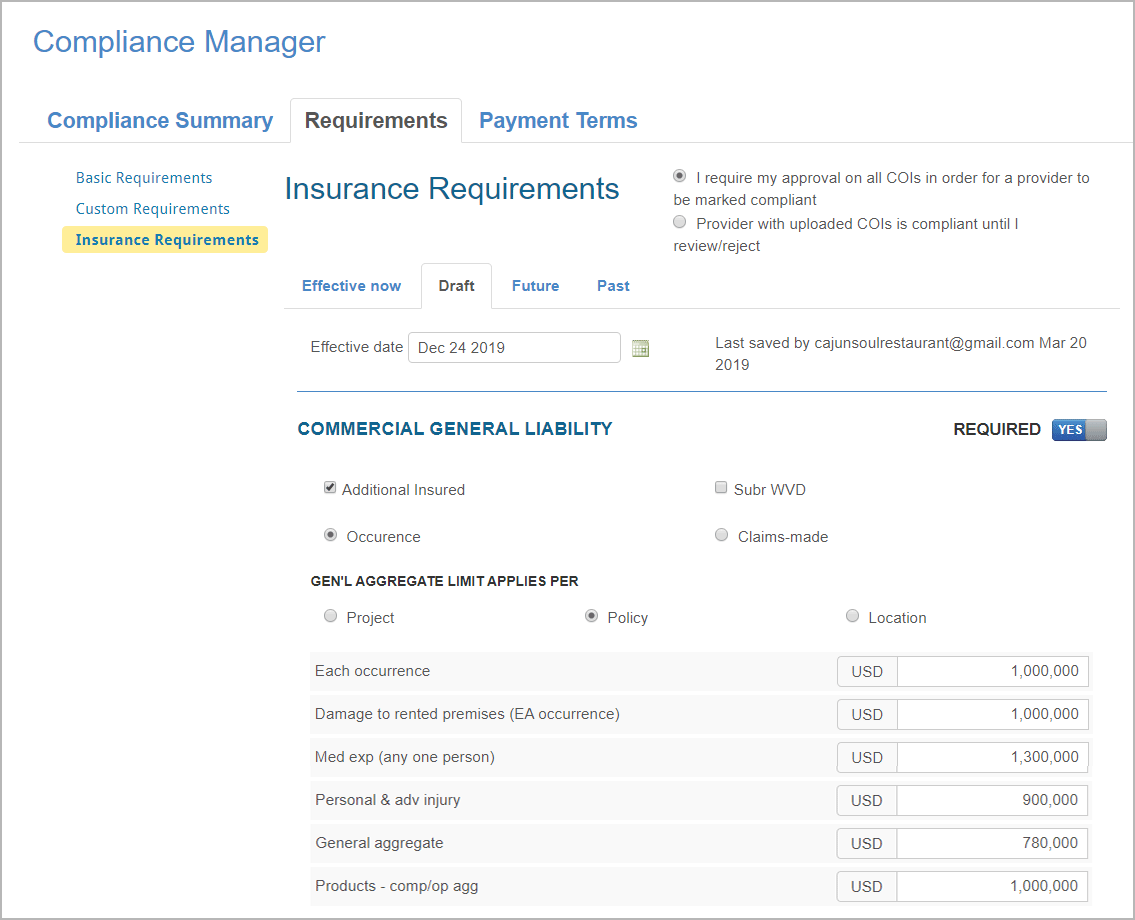

In the Insurance Requirements section of Compliance Manager, you may set any or all of the following four types of insurances as requirements:

- Commercial General Liability

- Automobile Liability

- Umbrella Liability / Excess Liability

- Workers Compensation and Employers’ Liability

Types of Insurance

Commercial General Liability. Select coverage type between Occurrence or Claims-made, and specify amounts (in US Dollars) for each of the following categories:

- Each occurrence

- Damage to rented premises (EA occurrence)

- Medical expenses [Med exp] (any one person)

- Personal and advertising injury (Per adv injury)

- General aggregate

- Products - completed operations aggregate (Products - comp/op agg)

You may also specify whether the coverage should be endorsed with Additional Insured and/or Waiver of Subrogation, and whether the General Aggregate Limit applies per project, policy, or location.

Automobile Liability. Select any one category of automobile from the following: any auto, owned autos only, hired autos only, scheduled autos, or non-owned autos only. For the selected automobile, specify required amounts for the following:

- Each occurrence

- Damage to rented premises (EA occurrence)

- Medical expense (any one person)

Umbrella Liability / Excess Liability. Choose between Umbrella and Excess Liability, and Occurrence or Claims-made coverage, and specify the required amount for Each occurrence and Aggregate.

Workers Compensation and Employers’ Liability. Select Per statute or other type, and specify required amounts for:

- EL Each Accident

- EL Disease - each employee

- EL Disease - policy limit

In addition, specify the Description of Operations/Locations/Vehicles and the Certificate Holder.

The insurance requirements that you activate display in different tabs, based on the effective date.

- Effective Now - insurance requirements that are currently effective display here, along with the name of the user who last updated/activated the requirements.

- Draft - draft version of insurance requirements appear here. You may edit the draft version any time, and add new insurance requirements, set an effective date, and save the draft. From this tab, you can activate insurance requirements and notify your service providers.

- Future - Displays insurance requirements which have been activated and are effective from a future date.

- Past - Displays a log of changes made to insurance requirements, including the name of the user who made the change and the time and date when the change was made.

Creating a Draft Version and Activating Insurance Requirements

Under the Draft tab, you can create a draft version and make necessary changes until you activate the requirements. Once activated, the requirements appear in the Future tab until the effective date. From the effective date, the activated requirements appear in the Effective Now tab.

In addition, while you have a set of current (Effective Now) requirements, should you require, you may also activate future insurance requirements, which display in the Future tab until the effective date.

Setting Up Insurance Requirements

- On the Compliance Summary page, click the Requirements tab. The Basic Requirements page displays.

- In the left navigation menu, click Insurance Requirements. The Insurance Requirements page displays.

- Click the Draft tab. The last saved version of the draft, if any, appears, with details of the user name and time the draft was saved at the top.

Enter an Effective Date using the calendar.

The earliest effective date is minimum one day after the current date.

- Mark whether Commercial General Liability is required by selecting Yes or No, as desired.

- If Commercial General Liability is required, specify the following:

- (Optional) Select the Additional Insured and/or Subr WVD (Waiver of Subrogation) boxes.

- Select the coverage basis as either Occurrence or Claims-made.

- Select either Project, Policy, or Location as the desired basis in the General Aggregate Limit Applies Per field.

Enter the desired amounts for the following occurrences: Each occurrence, Damage to rented premises (EA occurrence), Med exp (any one person), Personal & adv injury, General aggregate, and Products - comp/op agg.

You may only enter up to the nearest USD amounts in these fields, up to a maximum of nine digits; cent values are not allowed.

- Mark whether Automobile Liability is required by selecting Yes or No, as desired.

- If Automobile Liability is required, specify the following:

- (Optional) Select the Additional Insured and/or Subr WVD (Waiver of Subrogation) boxes.

- Select the desired type of automobile from the list.

- Enter required amounts for Each occurrence, Damage to rented premises (EA occurrence), and Med exp (any one person).

- Mark whether Umbrella Liability / Excess Liability is required by selecting Yes or No, as desired.

- If Umbrella Liability/Excess Liability is required, specify the following:

- (Optional) Select the Additional Insured and/or Subr WVD (Waiver of Subrogation) boxes.

- Select either Umbrella Liability or Excess Liability as the desired liability type.

- Select either Occurrence or Claims-made as the desired coverage basis.

- Enter the desired required amounts for Each Occurrence and Aggregate.

- Mark whether Workers Compensation and Employers’ Liability is required by selecting Yes or No, as desired.

- If Workers Compensation and Employers’ Liability is required, specify the following:

- (Optional) Check the Subr WVD (Waiver of Subrogation) box.

- Select whether the liability is Per statute or Other.

- Enter the desired amounts for EL Each Accident, EL Disease - each employee, and EL Disease - policy limit.

- Enter the desired description in the Description of Operations/Locations/Vehicles box.

- Enter the desired address to appear in the insurance certificate in the Certificate Holder box.

- (Optional) Upload a sample insurance certificate: Click Select, and browse to the location of the desired file, and select the file. The attachment lists in the Upload Sample section.

Click Save changes. The draft version is saved, and the top section of the screen displays your user name and the date and time the changes were made.

Once you create a draft, you may modify the draft version any time until you activate the requirements.

- To activate insurance requirements and notify your service providers, at the bottom of the screen, click the Activate and Notify Contractors button. A pop-up appears.

- Click the View Email button at the bottom of the pop-up. The Send notification pop-up window appears.

(Optional) Edit the message as desired.

To include an image or a link to an external website, use the edit options available at the top of the message area.

- (Optional) Clear the Attach Sample from Requirements box to remove the sample, which is by default attached to the email.

- Click the Activate and Notify <#> Contractors button. Email notifications are sent to service providers, and the number of notifications that processed and the number of notifications that failed display.

- Click Details to view the delivery status of the processed notifications.

- Click Close. The Draft tab displays.

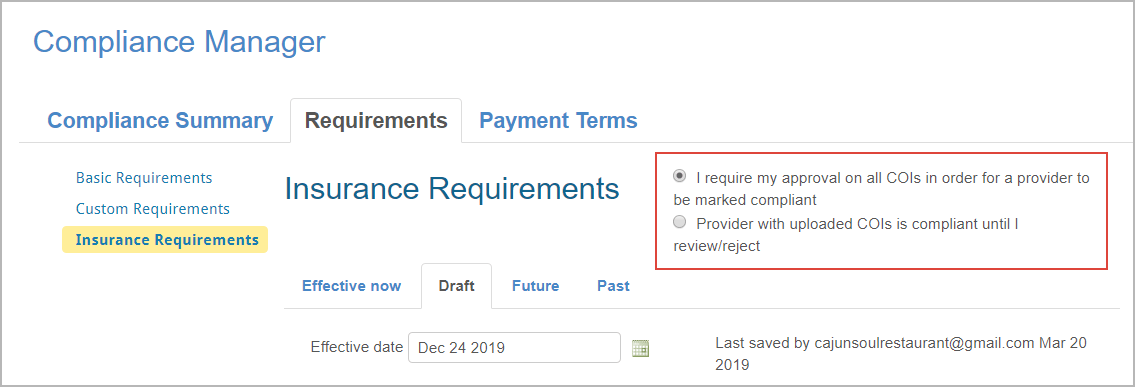

Deciding When to Consider Providers Compliant

When you set insurance requirements for your providers, you can specify at what point companies should be marked as compliant: right after they submit the required insurance certificates, or only after you review and approve all certificates.

To set whether your approval is required, select one of the radio buttons at the top of the insurance requirements list.

- I Require My Approval on All COIs in Order for a Provider to Be Marked Compliant.

To become compliant, your providers should submit all the required certificates of insurance (COIs) and wait until you approve them.

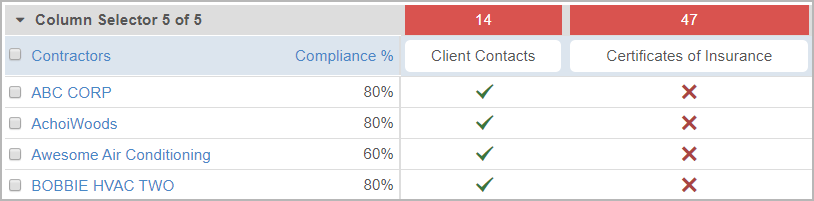

Once they provide the COIs, you see a red cross symbol to the right of each company under the Certificates of Insurance column on the Compliance Summary page, which means that these companies are out of compliance and their certificates are awaiting your review.

- Provider with Uploaded COIs is Compliant Until I Review/Reject.

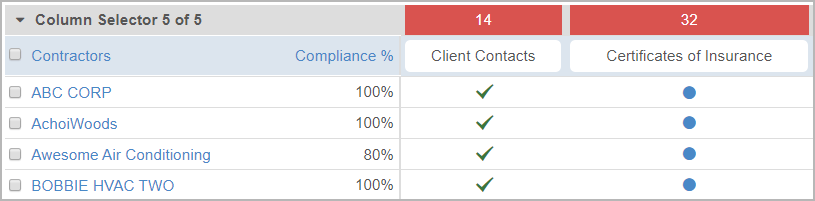

Providers don’t have to wait for your approval — they are treated as compliant with insurance requirements right after they upload the required certificates. When you have a chance to review the COIs, you can approve or reject them.

After providers submit their COIs, you see a blue circle symbol next to the company names under the Certificates of Insurance column header on the Compliance Summary page. The symbol indicates that the certificates are waiting for your review.

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

- No labels